By Nick Beams.

Reposted below is the perspective published on wsws.org here on July 01, 2025

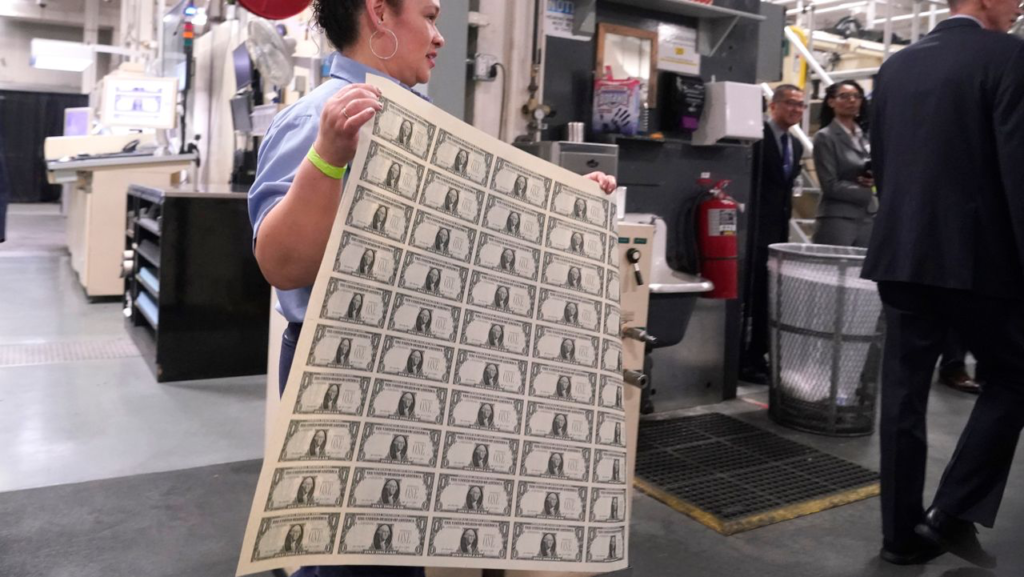

The US dollar has had its worst start for the year since 1973, in the wake of President Nixon’s August 1971 decision to remove its gold backing and abrogate the Bretton Woods Agreement of 1944, which had been a central plank of the post-war monetary order established after the chaos of the 1930s.

In the first six months of the year, it has fallen by more than 10 percent against a basket of six major currencies, in a sign of a loss of confidence in its status as the dominant currency and a safe haven in periods of financial turbulence and stress.

The dollar had been under downward pressure from the beginning of the year, with a turning point in its slide coming after April 2, when Trump announced the imposition of massive “reciprocal tariffs” on a range of countries.

The upending of the post-war international trading system signified by this decision set off financial turbulence, with a significant fall in the US bond market sending yields (interest rates) higher.

But instead of there being a move into the dollar, considered to be the “normal” response, there was a dollar selloff, sending its value in currency markets down as the prevailing theme was “sell America.”

This downward movement has continued despite Trump’s decision on April 9 for a 90-day pause in initiating the tariff hikes to allow negotiations to take place. Trump was responding to a selloff in the bond markets, which he said had started to get a little “yippy.”

In the near three-month period since then, no agreements have been announced, except for a deal with the UK, and nervousness is returning with the July 9 deadline for the end of the pause approaching. The concern is not only on the blanket reciprocal tariffs, but involves other measures announced by Trump, in particular, the tariff hikes on autos, which are directed against Japan and Germany.

Japan has been engaged in a series of discussions with the Trump administration over the tariff hikes, which threaten to cost its car industry tens of billions of dollars, but no agreement has been reached.

In comments to the Financial Times on the dollar’s slide, after it dropped by a further 0.5 percent yesterday, a foreign exchange strategist at the financial firm ING, Francesco Pesole, pointed to some of the reasons.

“The dollar has become the whipping boy of Trump 2.0’s erratic policies,” he said, citing the tariff war, the growth of US debt, and the continued attacks on the independence of the US Federal Reserve.

Trump has labeled Fed Chair Jerome Powell a “numskull” and a “moron” for his refusal to cut interest rate cuts in line with his demand that the Fed rate be reduced to as low as 1 or 2 percent from its present level of 4.5 percent.

The turbulence resulting from Trump’s agenda and the increase in the debt flowing from his tax-cutting budget, which could see as much as $3.2 trillion added to the US debt mountain of $36 trillion, were cited in comments by economists in a poll conducted by the FT.

In its report on the poll, it said that Trump’s “breathtaking fiscal policy excess,” together with “attacks on the Federal Reserve’s independence, risk diminishing the US’s status as the ultimate safe haven for foreign investors.”

A comment by Saroj Bhattarai of the University of Texas at Austin summed up the prevailing sentiment.

“The safe-haven assets appear to be [the] Swiss Franc and gold. In fact, [the] US looks like an emerging market, whereby policy uncertainty leads to rising risk premia that drive long-term yields up and the currency value down.”

Citing what took place after April 2, dubbed by Trump as “liberation day,” Evi Papa, an economist at a major Madrid University, said: “US Treasury [bonds] might not be a safe asset anymore.”

Lack of confidence in the US dollar is driving the price of gold to new highs – it has risen by around 25 percent this year and at one point hit $3,500 per ounce, 100 times its price of $35 when Nixon removed the gold backing from the US dollar. One of the drivers of the rise is increased buying by central banks.

The Taxpayers Association of Europe (TAE) has even sent letters to the finance ministries and central banks of Italy and Germany, urging that their gold held in the Fed’s gold vault in Manhattan be moved out.

TAE President Michael Jäger told the FT: “We are very concerned about Trump tampering with the Federal Reserve Bank’s independence.”

Those fears are not misplaced when it is recalled that the removal of the gold backing from the US dollar in 1971 was simply announced on Sunday night television without any discussion with other powers.

As the dollar slide continues amid mounting debt, there is a real prospect that the Trump administration could act unilaterally at any stage.

One idea circulating in the economic circles of the Trump regime is that US Treasury bonds could be turned into perpetual bonds, that is, while they would continue to pay interest, the principal would never be repaid – an action that would be regarded as a default by the US on its debt.

This was rejected by Treasury Secretary Scott Bessent back in April, but the fact that he had to quash it, at least for the present, is an indication of the kind of measures being discussed as the debt crisis deepens.

While the actions of the Trump administration are the proximate cause of the dollar decline, they are themselves the outcome of the historic crisis of US imperialism, rooted in its long-term economic decline.

When global capitalism was restabilized after the war, not least by the Bretton Woods Agreement, it was the industrial powerhouse of the world. It used that power to establish economic order after the chaos of the 1930s.

This was not a product of the benevolence of the US. It was based on the recognition that unless this were done, then the world, and the US, would return to the conditions of the Depression, bringing with it the prospect of social revolution.

But the revival of the world economy steadily undermined the dominant position of the US in world trade, leading to balance of payments and trade deficits, which meant it could no longer redeem dollars for gold.

Following the Nixon decision, the dollar retained its position as the global currency. But it did so on new foundations. It was a fiat currency, no longer backed by value in the form of gold, but by the power of the US state and its financial markets.

However, the rise of finance, which this entailed, set in motion processes that have led to the present crisis. Over the past 50 years, the US has become the center of financial parasitism and speculation, resulting in a series of financial storms – the October 1987 stock market crash, the collapse of the dotcom bubble in 2001, the crash of 2008, and the Treasury market freeze of March 2020, to name some of the more prominent.

Throughout this period, there has been an escalation of government debt, not least because of the increase in military spending and massive corporate bailouts. This is reflected in the growth of the Treasury market, where government debt is bought and sold, from around $5 trillion in 2008 to $29 trillion today.

The rise of parasitism and speculation as the chief driver of profit accumulation, leading to the rise of an oligarchy based on finance capital, is indicated by the fact that just 15 percent of financial market transactions are involved in the development of new investments, with 85 percent based on dealings in financial assets.

Finance capital cannot continue to endlessly accumulate, seemingly creating profit out of thin air, through debt. All financial assets, shares, debt, and the various other arcane mechanisms are, in the final analysis, a claim on the surplus value extracted from the working class.

Consequently, there is no peaceful solution to the mounting crisis within the framework of the capitalist order. For the US, this means the intensification of war, on the economic and military front, as it seeks to batter down its rivals, foes like China, as well as erstwhile allies in Europe, coupled with a war against the working class at home, enforced by a dictatorial regime.

Nor is there the prospect of a so-called multipolar world where currencies coexist and peacefully compete, as is being advanced by China and increasingly by Europe. That road is a return to the economic conflicts of the 1930s, which led to World War II. This is why, in the midst of deepening economic turmoil, governments around the world are arming and rearming.

The dollar-debt crisis is rooted not simply in the personality and actions of Trump – he is only the most malignant expression of the historic bankruptcy of the capitalist system as a whole.

It places before the working class the necessity to end this system of war, economic crisis, deprivation, fascistic and authoritarian regimes in the political struggle for international socialism and the building of the world party of socialist revolution, the International Committee of the Fourth International, to lead it.